Shock horror to a few people we know well, that their houses are not worth squillions over what they paid for them, and worse, for those with interest only payments, the house is now in negative equity!

Is this the start of a new era of falling house prices and property becoming a poor investment?

On the first point, not an era . yet. For now this is a correction as banks just won't lend 100% for first time buyers who present the biggest risk to them in defaulting.

This has a very immediate knock on effect to the market and it works like a steep pyramid at this point thus:

First time buyers tend to be on a metropolitan and suburban basis, youngish people buying a flat. Second homers of the geo-socio-demographic tend to be those who have just become parents. Here you have the first multiplier- two flats to sell which makes for a large amount of capital paid down or gained over the years - and we are having those kids and those three bedroomed properties later.

In order to move up, they have to sell at a profit and of course actually sell on time to avoid bridging loans and uncertainty. It is this key multiplier which has put the brakes on the housing market and caused many sectors of the market to fall in value for the first time in two decades.

The older key mulitplier of days of yore in the 1970s, 80s and 90s was that when wages go up x% points, mortgage borrowing goes up x% x 3 because we can borrow on three times income. That was trashed about in with on the one side big capital gains and disequity across geographical areas, and then dodgey mortgages on 5 times individual or couple's joint income.

This correction in the market comes as a surprise to many, but we have seen similar before in the 80s , 90s and around 2000-2003 depending where you live. Those falls were caused in part by over-valuations and overloaning too, but the gap being one step up in the market that suddenly property values were so vastly over geared to annual average incomes that a proportion of the population in the areas affected were either stuck with where they lived, unable to move up, or like me stuck with having to rent and share apartments to be able to save up for a mortgage.

The belief system is still there that housing is a good SHORT term investment amongst the public- you get a capital gain and alter your gearing, and your wages or other income rises allowing you to go on with the rat race until you have an appropriately sized cage to bore everyone to death in.

However it may be the banks and legislators who now actually put water on this belief system, and turn home ownership once again into a longer term investment. Governments in many countries or regions of countries with economic up swings over the last decade, have been involved in freeing up land and allowing for more provision in the market, while unfortunetly the developers understand a lot about gross margin but zero about demographics and have built endless yuppie rabbit hutches across the western world, and to some extent probably in the east. The hang over from this will be that there can be more building once the correction runs its course- this will mean developers are less likely to get rich quick, more run a reasonably profitable business based on hard work and good knowledge of the market socio demographic. Also unemployment in this sector is still rising in many countries because there was a hang over of projects (read rabbit hutches) which institutional investors amongst others were patient enough to run out the finance crisis,- which suggests something acute rather than what it turned into - a chronic failure in the ideologies of the free market to function without more 'federal' governance. So there is a scene set to have quite a lot of supply in rabbit hutches, and developers who see them standing empty and families trying to shoe horn themselves in, and then look to actually listening to the market and building to the demographic. Major employers will put pressure on local and national politicians to plan or free up land as the ideological dogma would presuppose. You then have labour available and cheaper than before for a while.

There will be booms and bubbles again, but a lot of people on interest only mortgages are going to be looking in their midterm to the need to pay capital down to avoid negative equity and to increase ROI. ..

so given the two above as "for example" in a scenario build you could then throw bones and tea leaves and say that there will be now a longer term adjustment in the western world, especially in some of the very over valued "provinces" .. I ramble but there will maybe be then a long term correction in enough of the market as to render the property shine into a dull glow and as I say, return home and property to being a long term, responsible and low risk investment instead of a short term, high reward, high risk invesment in enough of the populations to affect this change.

Wednesday 6 November 2013

Tuesday 29 October 2013

Cash is King.. understanding Cash Flow and Technology SMEs

Two things I found out - one I had been doing far too much management accounting which I was not getting paid for, and secondly I had invented my own perfect cash flow forecast and analysis spreadsheet for the minutiae of home economics.

This little video sums it up pretty nicely, and I have been through an hour or so on youtube and really this is the deal anyway! ( the business owner looks and sounds a bit like Scarlett Johansson too)

The most interesting issue is that businesses can actually survive with no profitability far longer than they can without cash flow. When the cash in versus cash out is negative when the last bills come to be paid, then technically the patient is dead: the heart has been deprived of blood and dies: the company is bankrupt.

Even whole nations have to be cash flow pedantic- look at the USA recently with the debt ceiling- raising cash for net working capital- is all about cash flow and covering shortfalls in income while there being a lag in being able to reduce costs, in this case mostly defence cuts.

So countries and the EU as a body, need to be able to collect money, pay people and the raise any funds to cover the deficit. Companies can use the same principles of debt rescheduling and raising funds, but both CEOs and politicians are best advised to balance the books as much as they can and for the SME sector then really I believe that putting investment into infrastructurem brand building and enabling or key sellable technologies aside, then companies need to both demonstrate they have positive cash flow based on their gross margin and sales cycle for given periods, while also having the discipline in creating positive cash flow at key period ends.

A lot of technology companies are purely an academic exercise until the point at which they can see income on a monthly basis: This should be clear to investors, they are either investing in nerds in what is essentially a private university, or they are investing in entrepreneurs who can convert nerd hours into cash.

Monday 16 September 2013

Finance Crisis Granularity and Psychology

There are pundits who claimed to have forseen the finance crisis of 2008, but realistically the same as the internet bubble and not the least the great depression in its time, realistically it is only with hindsight that it became an obvious catastrophe waiting to happen.

What is the problem which cannot be cured? At the core of this is that there is a high degree of granularity- different transaction orientated processes and employees. No one person or institution could see the bigger picture, the wood for the trees. Some macro economists could do the sums and say that western society had loaned itself too much money, even without the need to delve into the transactions at the bottom of the house of cards, the sub prime mortgage fiasco. That only served to precipitate the down fall, any flap of a butterfly's wing in the system could have shaken it down.

The fact is that no one person, be them chancellor or proffessor, and no one institution can understand enough of the "markets" at any one time to predict where it is going. Economists should admit to being like the native American tribe who saw themselves as travelling backwards through life, with their faces only exposed to that which had been experienced. All in front of them, was mystery they were blind to.

In legislating then the issues revolve around this transaction oriented granularity: the tiny fiefdoms of stocks, derivatives, commodities and the more complex financial mechanisms which are the rot in the whole system. You cannot make one set of rules which fits all, and cog in the machine will defend itself against new laws which they see as unduly straining their resources and making them less competitive.

In economics classes, talking about the gold standard was either taken in kind of being prehistoric, an extinct dinosaur of early global economics, or as a bit of a naieve joke for children's hour. However it was seriously suggested by some prominent economists as a cure to the finance crisis, and actual bone of confidence for banks and countries to hold as their bedrock of fluidity. A lot of money moved into precious metals at the finance crisis only to find demand was also eroded in value and being victims of that "listen with mother" law of economics.

Governments are being scared off further legislation than in fact a simple extension of the gold standard principle of limiting money supply and loaning to a credit limit which has some relation to a liquidatable value. For each powerful transactional level in the great casino, there is a lobby firm and owned politicians and political parties. Each clips round its territory and hopes that legislation wont affect their little value chain while sound and prudent financial management happens at national bank and government level.

So that is the nature of the beast perhaps: it is a medusa which has no single purpose, no collective conscious, no single direction and is only seen as cohesive by each head behaving in a similarily grabbing way, dragging the physical body of wall street and the city of Westminster with them. If you cut off one head, the others will round on you afraid they will be next.

What is the problem which cannot be cured? At the core of this is that there is a high degree of granularity- different transaction orientated processes and employees. No one person or institution could see the bigger picture, the wood for the trees. Some macro economists could do the sums and say that western society had loaned itself too much money, even without the need to delve into the transactions at the bottom of the house of cards, the sub prime mortgage fiasco. That only served to precipitate the down fall, any flap of a butterfly's wing in the system could have shaken it down.

The fact is that no one person, be them chancellor or proffessor, and no one institution can understand enough of the "markets" at any one time to predict where it is going. Economists should admit to being like the native American tribe who saw themselves as travelling backwards through life, with their faces only exposed to that which had been experienced. All in front of them, was mystery they were blind to.

In legislating then the issues revolve around this transaction oriented granularity: the tiny fiefdoms of stocks, derivatives, commodities and the more complex financial mechanisms which are the rot in the whole system. You cannot make one set of rules which fits all, and cog in the machine will defend itself against new laws which they see as unduly straining their resources and making them less competitive.

In economics classes, talking about the gold standard was either taken in kind of being prehistoric, an extinct dinosaur of early global economics, or as a bit of a naieve joke for children's hour. However it was seriously suggested by some prominent economists as a cure to the finance crisis, and actual bone of confidence for banks and countries to hold as their bedrock of fluidity. A lot of money moved into precious metals at the finance crisis only to find demand was also eroded in value and being victims of that "listen with mother" law of economics.

Governments are being scared off further legislation than in fact a simple extension of the gold standard principle of limiting money supply and loaning to a credit limit which has some relation to a liquidatable value. For each powerful transactional level in the great casino, there is a lobby firm and owned politicians and political parties. Each clips round its territory and hopes that legislation wont affect their little value chain while sound and prudent financial management happens at national bank and government level.

So that is the nature of the beast perhaps: it is a medusa which has no single purpose, no collective conscious, no single direction and is only seen as cohesive by each head behaving in a similarily grabbing way, dragging the physical body of wall street and the city of Westminster with them. If you cut off one head, the others will round on you afraid they will be next.

Monday 2 September 2013

The Society We Live In

I live now in Norway, a society which is actually at a possible turning point towards the more conservative, racist, self centered view on life. I can understand, we have had problems with immigrants especially from islamic countries and criminals from eastern europe.

However the beyond the obvious lose points like assylum seekers getting free dentistry while pensioners don't, there is a possible change to greed and everyone wanting more than their fair share: ie a move to more like the conservative support in the UK. "I'm allright jack, and go do with some more!!"

What society has the UK and the US become? I feel the uk is ever more like the US with a growing obese drudge working class and an under class, while the only way to make any money is to be a legalised crook.

What example does the invasion of Iraq and the financial crisis set for citizens? These were quasi legal crimes, with elements of illegal actions from institutions which are supposed to be respected and seen as leaders in society.

Back in my old home town, a mixed old place of rich, poor and day trippers going down the seaside, there have been drug wars and there is an increasingly large number of skanky looking types in their twenties and thirties driving flash cars and doing steroids: ie drug dealing on the side of a normal job, or ducking and diving on the wrong side of the law, or just cheating to get bigger loans than most people on those incomes.

The left wing parties who strove for rights to weekends free, breaks at work, safe environment in the factory or office, 40 hour week, equal pay for women and so on, are now reduced to a side show with some once strong labour seats struggling with party membership in the tens and not even boasting 100 members for the constituency.

However it is inevitable that social strife, criminality and inequality lead to a rise in community movements and collective action. The conservative dream of everything being privatised and a small state is just what we had pre-war in the UK and other now EU countries- a large minority of society living in poverty like a third world country. During the war almost a third of the population in the UK eat a BETTER diet during rationing.

Britain has always been at its greatest during times of collective action: in war, in home defence and in rebuilding society.

However the beyond the obvious lose points like assylum seekers getting free dentistry while pensioners don't, there is a possible change to greed and everyone wanting more than their fair share: ie a move to more like the conservative support in the UK. "I'm allright jack, and go do with some more!!"

What society has the UK and the US become? I feel the uk is ever more like the US with a growing obese drudge working class and an under class, while the only way to make any money is to be a legalised crook.

What example does the invasion of Iraq and the financial crisis set for citizens? These were quasi legal crimes, with elements of illegal actions from institutions which are supposed to be respected and seen as leaders in society.

Back in my old home town, a mixed old place of rich, poor and day trippers going down the seaside, there have been drug wars and there is an increasingly large number of skanky looking types in their twenties and thirties driving flash cars and doing steroids: ie drug dealing on the side of a normal job, or ducking and diving on the wrong side of the law, or just cheating to get bigger loans than most people on those incomes.

The left wing parties who strove for rights to weekends free, breaks at work, safe environment in the factory or office, 40 hour week, equal pay for women and so on, are now reduced to a side show with some once strong labour seats struggling with party membership in the tens and not even boasting 100 members for the constituency.

However it is inevitable that social strife, criminality and inequality lead to a rise in community movements and collective action. The conservative dream of everything being privatised and a small state is just what we had pre-war in the UK and other now EU countries- a large minority of society living in poverty like a third world country. During the war almost a third of the population in the UK eat a BETTER diet during rationing.

Britain has always been at its greatest during times of collective action: in war, in home defence and in rebuilding society.

The Puppeteers- Religion, Politics and Sex all in One Pico Rant

Pico rant time again:

I wonder how much the USA evangelical TV channels and media spend is compared to how much the "churches" actually give away in Christian Charity?

Why are we such terrible remote controllers, wanting to spread our message by word and not actions? The puppeteers, wanting to control the strings in religion, politics and sex but needing not to get involved in practicing what we preach?

I know that I spend right now more time blogging that doing anything for anyone in the wider community, but I feel very strongly associated to christian, egalitarian and very left wing views. Jesus was after all, a communist revolutionary.

The effort people make in influencing others by communication in the media or in the street rather than by action seems disproportionate and in fact at the root of the human condition- third reich and all in this one!

I wonder how much the USA evangelical TV channels and media spend is compared to how much the "churches" actually give away in Christian Charity?

Why are we such terrible remote controllers, wanting to spread our message by word and not actions? The puppeteers, wanting to control the strings in religion, politics and sex but needing not to get involved in practicing what we preach?

I know that I spend right now more time blogging that doing anything for anyone in the wider community, but I feel very strongly associated to christian, egalitarian and very left wing views. Jesus was after all, a communist revolutionary.

The effort people make in influencing others by communication in the media or in the street rather than by action seems disproportionate and in fact at the root of the human condition- third reich and all in this one!

Saturday 27 April 2013

A quick Point about Dogmatic Ideologies

Dogmatic Ideologies have their day.

Naziism came and went as a political force for .

Communism too.

Now it is the turn for free-market-fundamentalism to face their own Berlin Wall.

They have had pretty much close to their logical ideal, but it became like the regime of Paul Pot to his ideology: The finance crash was a result of the very lack of controls they persuaded everyone would be good for us, and also that in fact the way it was, the free market in the west was dependent on state-planning in the far east.

Finally of course, the banks socialist style bail outs, as did failing industries in the 1970s.

Naziism came and went as a political force for .

Communism too.

Now it is the turn for free-market-fundamentalism to face their own Berlin Wall.

They have had pretty much close to their logical ideal, but it became like the regime of Paul Pot to his ideology: The finance crash was a result of the very lack of controls they persuaded everyone would be good for us, and also that in fact the way it was, the free market in the west was dependent on state-planning in the far east.

Finally of course, the banks socialist style bail outs, as did failing industries in the 1970s.

The End of The Post-Democratic-Era

It became very trendy amongst the opinion leading dissafectionists in the Blair-Clinton era that we lived in a post democratic era. Their point being that Despite there being liberal leadership, the world had moved away from democratic influence to a global conspiracy of capital and the illuminatae.

I see that this view point was both vindicated by the subsequent GW Bush administration's history, but also the apathetic view point of inevitability and all that, is now reversed.

That democracy had become even more of a media-surface for meta-politics under the GW Bush reign is something which is glaringly obvious. Unlike 1930s Germany, we aren't going to believe this vaneer any more.

We had indeed drifted into an era where "meta democracy" was more influencial than parliamentary, election sourced democracy. In other words, other institutions and influences were taken as more important in policy making, and in fact were able to direct policy making. When I say "we drifted", we, the electorate allowed ourselves to drift into power being moved to capital and international federations or organisations. Much of influence and decision making went to the back door. This was far from a "drifting": this was very much directed in the interest of those organisations.

The most insidious wing of this all is the "small government" wing, who actually are funded by big meta-governance: corporates and the super-rich who want to steer the public away from the idea that electoral democracy can change anything.

My assumption now is that I have just an average level of intelligence, not by IQ testing, but by just how humans reason and propose and make opinions and actions which affect the world around us. The second is that the drift to anarchy in the stock markets and money markets was the symptom of their not being a big single nazi style reich of Davos super people trying to run the whole show in a Machiavellian way.

The wealthy and their wealth mongers, wanted more freedoms, and many of those were rightly so washing away years of tedious beaurocracy. However they created their own monster which is that with money on the table, people will lie and cheat when they see a way round the system and if there is NO system then people will only lie and cheat. Ipso Facto: Finance crisis soon to enter its sixth year.

My third assumption is really what is happening in the USA this last week, that people are in general common and decent and don't like meta democracy be it the Davos group or the National Rifle Association. As seen with the Five Star movement in Italy, people want democracy back and they want it to be different.

One aim of the big-meta-governance (corporates and super rich) lobby is to make enough of the population either (hopelessly) aspirational or apathetic: to ensure that the ordinary joe and jane who would drift to liberal tendencies in the face of big-bad-capitalism as it used to be, that these ordinary joes are kept apathetic because parliamentary democracy is a castrated organ. To then ensure that the striver types and the bourgeois are then aspirational enough to believe that only their own efforts will better the world around them, and government is inherently bad news.

I believe we are now at a turning point: the best countries in the world to live in are all liberal countries, where even the right wing have to, or want to uphold values and rights for working people and the less fortunate in society. Democracy matters once again enough for it to be taken back.

I even have to admire wee Davey Cameron on this point: the Federal Europe of Brussels and back doors, needs to be re-examined. Politics also on the domestic front needs to make a change, although the scrooge tactics against ordinary people in periods of unemployment will back fire as they will now place probably over a million workers into that self same position by their other "austerity" policies: Also Davey Came'y did not like the attitudes of GW bush or Romney and said quite openly, tha Obama was someone he could work with: this because Obama at least respects the UK unlike Bush who saw it as "Airstrip One" , a poor country cousin state supplying troops and weapons and oil.

Movements then as diverse as the Five-Star-Alliance to the UKIP then are all signs that people are taking democracy more seriously and want to grab back power before we have a descent into a fascist scramble for power from the elite, to fill the vacuous ideology of the never ending sunshine of the free market. If you let the free market run too free, it becomes anarchy.

Also what free market anyway? We get our gross margin made in China, which has a weird kind of command-capitalist-economy and a communist outlook on social planning.

That democracy had become even more of a media-surface for meta-politics under the GW Bush reign is something which is glaringly obvious. Unlike 1930s Germany, we aren't going to believe this vaneer any more.

We had indeed drifted into an era where "meta democracy" was more influencial than parliamentary, election sourced democracy. In other words, other institutions and influences were taken as more important in policy making, and in fact were able to direct policy making. When I say "we drifted", we, the electorate allowed ourselves to drift into power being moved to capital and international federations or organisations. Much of influence and decision making went to the back door. This was far from a "drifting": this was very much directed in the interest of those organisations.

The most insidious wing of this all is the "small government" wing, who actually are funded by big meta-governance: corporates and the super-rich who want to steer the public away from the idea that electoral democracy can change anything.

My assumption now is that I have just an average level of intelligence, not by IQ testing, but by just how humans reason and propose and make opinions and actions which affect the world around us. The second is that the drift to anarchy in the stock markets and money markets was the symptom of their not being a big single nazi style reich of Davos super people trying to run the whole show in a Machiavellian way.

The wealthy and their wealth mongers, wanted more freedoms, and many of those were rightly so washing away years of tedious beaurocracy. However they created their own monster which is that with money on the table, people will lie and cheat when they see a way round the system and if there is NO system then people will only lie and cheat. Ipso Facto: Finance crisis soon to enter its sixth year.

My third assumption is really what is happening in the USA this last week, that people are in general common and decent and don't like meta democracy be it the Davos group or the National Rifle Association. As seen with the Five Star movement in Italy, people want democracy back and they want it to be different.

One aim of the big-meta-governance (corporates and super rich) lobby is to make enough of the population either (hopelessly) aspirational or apathetic: to ensure that the ordinary joe and jane who would drift to liberal tendencies in the face of big-bad-capitalism as it used to be, that these ordinary joes are kept apathetic because parliamentary democracy is a castrated organ. To then ensure that the striver types and the bourgeois are then aspirational enough to believe that only their own efforts will better the world around them, and government is inherently bad news.

I believe we are now at a turning point: the best countries in the world to live in are all liberal countries, where even the right wing have to, or want to uphold values and rights for working people and the less fortunate in society. Democracy matters once again enough for it to be taken back.

I even have to admire wee Davey Cameron on this point: the Federal Europe of Brussels and back doors, needs to be re-examined. Politics also on the domestic front needs to make a change, although the scrooge tactics against ordinary people in periods of unemployment will back fire as they will now place probably over a million workers into that self same position by their other "austerity" policies: Also Davey Came'y did not like the attitudes of GW bush or Romney and said quite openly, tha Obama was someone he could work with: this because Obama at least respects the UK unlike Bush who saw it as "Airstrip One" , a poor country cousin state supplying troops and weapons and oil.

Movements then as diverse as the Five-Star-Alliance to the UKIP then are all signs that people are taking democracy more seriously and want to grab back power before we have a descent into a fascist scramble for power from the elite, to fill the vacuous ideology of the never ending sunshine of the free market. If you let the free market run too free, it becomes anarchy.

Also what free market anyway? We get our gross margin made in China, which has a weird kind of command-capitalist-economy and a communist outlook on social planning.

Friday 19 April 2013

De-growth and Natural Western Economic Downsizing

Growth in GDP has been the central mantra of all orthodox and respected economists in modern times, and quite possibly been the theme which was born when the term economy was first used.

Now we are currently and quite probably in a phase in western economies where there is contraction in the general economy, and GDP will fall in many western countries, or be subject to vagiaries of key commodities or economic activities such as the financial markets in actually determining any net growth on top of a more general down-sizing happening on several levels.

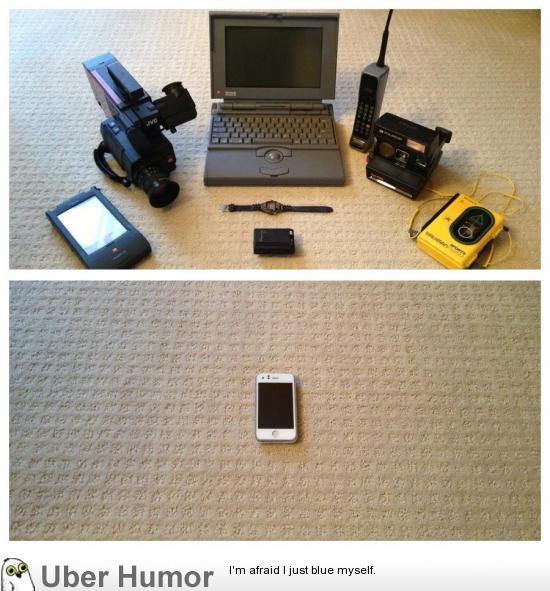

Firstly on the personal level, we see the example above of how modern products are down sizing demand. HTC in particular are victims of their own succsess- I own a 2 year old Desire and it is in very good working order, able to run all but the heaviest new software app's on the market and a sturdy multitasking phone with a great camera. Apple build in "style obsolescence which is a massive intellectual and logtistics activity to get their brand bought when in fact the old product matches the physical needs.

I believe the economic recession is more than just a normal stage in the previous post war cyclical pattern I grew up with. Rather, the cause is the symptom and the reason change is so slow now: the west became increasingly locked into a financial system which was anarchic and the previous mechanisms for extracting value from the movements of money, commodities and capital evolved into a free-for-all where cheating became the norm, dressed up in ever more fancy language.

Basically western economies were not adding enough value to goods and services, while investment in the far east and emergent nations as the providers of basic value-multiplication centres, was restricted by Chinese, Indian, Korean and Brazilian governance.

Some pundits talk of the sub prime social policy as being the root cause of this collapse, and point to governmental intervention and the butterfly-effect meaning that any distortion to a market can have these seismic ripples. However they are most often the same bankers and economists who support bail outs for failed, high risk and law breaking banks and austerity measures which will restrict growth further and place more western workers out of work, while also cutting demand for western products in the emergent economies in a viscous circle. Oil and gold this week are both down.

Rather I say that the over valuing of markets and the over stating of returns on complicated and often illegal financial products or vehicles, was inevitable and the sub prime was just the final catalyst for it all to happen.

De-growth is then actually not a consequence of the finance crisis, it is one of the causes and itself now is being exacerbated by austerity measures. It is a natural phenomenon that the west will drift into Keynesian cyclical service industry and higher intellectual value, lower employee per dollar margin activities such as finance and design within high technology areas. Also that the gross margin enjoyed form the early nineties to early nought'ies by western companies with their brand management and design, is now running over to Korea, Japan and China with the next layer building up in other BRICKS countries whose business graduates know the game: brand is king of margin.

On some of the governmental sides, the USA in particular and Europe will see a steady decline in defence spending, with the Right's own economic rottweilers questioning every dollar or Euro spent on this. It doesn't look great for many in defence: right sizing of armies as the west re-thinks invasive policies in Islamic countries, down sizing our navy due to advances in technology and the re-tasking they have in front of them, and then there is the biggest single project down size and potential catastrophe, the international F35 joint fighter which is down sized in orders, late and may not be the one size fits all it was billed to be.

Japan is the first major economy to turn its back on austerity: this is because it has had two decades nearly of slow growth. Germany will never need to follow suit? Well the austerity lead by the Germans will lead to far lower demand for the premium products and high quality technical expertise they have spent so long building as a brand and quality leader in the EU and internationally. The fact is that France, the UK and the low countries have not actually yet seen the real job losses which are a direct result of austerity that is being legislated now.

Many hark back to the cure of the mid to late 30s and a return to higher borrowing, higher cash flow and higher inflation as the only kick start to the west. Others say that recovery will be a natural result of good fiscal policy, but that is actually relatively speaking a hope-and-a-prayer versus established economic history. We are not in 1978 when an IT and liberalistaion revolution could be forseen and pushed through, we are in a time when the west is still loosing value creation to the far east without very much to liberalise without there being more basis for the same corruption and anarchy which lead us to this crisis.

Monday 15 April 2013

The Party Political Broadcast Tomorrow, Including Silencing Big Ben, is Brought to you By the Right

Thatcher wanted to make a statement on her way out, and her advisers would have known the political capital to be had in a nationalistic, state funeral in all but title.

She is being extolled to the height of Winston Churchill, with Big Ben being silenced and the route being long and lined by service people drawn out of defending the country.

Like many of the long lasting ironies, this will be a state subsidised event, maybe costing the state about the same it spends a week in one of the mining or steel communities devastated by her policies, or maybe just a few days of the housing benefit bill of a London borough, strapped by law to house people and while starved of council housing, has funnily enough masses of money to subsidise often rich landlords with poor quality accommodation

She is being extolled to the height of Winston Churchill, with Big Ben being silenced and the route being long and lined by service people drawn out of defending the country.

Like many of the long lasting ironies, this will be a state subsidised event, maybe costing the state about the same it spends a week in one of the mining or steel communities devastated by her policies, or maybe just a few days of the housing benefit bill of a London borough, strapped by law to house people and while starved of council housing, has funnily enough masses of money to subsidise often rich landlords with poor quality accommodation

Saturday 13 April 2013

Thatcher and Her Elephants

Maggie Thatcher can be said to be a figure head and a mouth-piece for many "New Right" thinkers of the mid 1970s, who then found a proponent, agent provocateur and prosecutor for their ideologies.

Two areas which however bore her own brand of decision making and personal bloody mindedness, are the great white elephants of public spending: firstly the Trident Missile system.

By the late 70s Polaris was deemed obsolete: who decides that a system which could destroy the entire Moscow area several times over with very little at the time in the way of stopping the missiles once launched, is down to the USA and that most manipulatable asset, British pride. Even the "Chevaline" upgrade can be viewed as a sticking plaster on an ageing fleet of submarines which had become expensive to keep operational and were heavily manned.

The proposals were for a new multi-warhead intercontinental peri-stratospheric missile system which would have less crew and more computerisation. The alternative was for cruise missiles: medium range missiles launched from torpedo tubes, or longer range ones probably launched vertically like other submarine bourne ICBMs. The latter is now of course in debate again: on the plus side, it is a weapon system you can actually find use for in crisis, by loading with conventional warheads and firing without alerting the Russian-Chinese ICBM long range alert systems, and not causing a diplomatic incident after satellite intelligence reveals launches, given the trajectory is towards a target not sensitive to the super powers.

Trident was chosen in the 80s as the system of choice and work began in 1984 in earnest in fact. The construction phase of the "Boats" and the shore support cost a figure between four and six billion pounds. The missiles and much of the system testing of their launch and use was delivered by the US, with funding quoted as being "38%" but that is probably just the cost of the missiles, and given they produce them anyway, it is difficult to say what 'subsidy" the Uk ever actually had from "uncle Sam".

It is Ironic of course that British sovereignty was challenged by Argentina, with disregard to the potential use of Polaris. The Fascist Junta knew that the UK would never be allowed to even threaten them with it due to the Americans actually holding the finger that is under the finger on the UK "Button".

Secondly the ICBM became largely obsolete, at least for the UK's geo-strategic position with the rise of Glastnost-Peristroika-Democracia in the then USSR.

Trident then was rendered a white elephant by 1990, when a submarine cruise launched system could have been re-tasked to conventional warhead or even intelligence "drone" flights of cruise missiles into Iraq. Also of course the UK Royal Navy has acquired medium range, torpedo launch cruise missiles since then which would have a nuclear war head capacity if rebuilding of systems was instructed.

So there it is Trident: and possibly Trident II. The modernisation and effectivisation the NHS never got and never will have.

Her next great and of course white, elephant was Canary Wharf. Over a billion pounds in subsidies in an otherwise "free market, let them eat coal" reign. A pure ideological, interventional government hand out to cronies which took years to fill and was a financial disaster for the original developers.

The last elephant was born of this ideology in fact: a birth on the alter of the anarchical finance markets: The elephant in the living room, the elephant on the stock market floor, the elephant in the EU Commission and in little Davey Cameron's bedroom, under his bed at nights. That the freedom and deregulation has inevitably lead to a vulnerable, interconnected quasi system open to the vagiaries of even a single trader or type of transaction causing turmoil. Like the butterfly effect proposed on global weather, the anarchic deregulated markets can sneeze at one end and catch a plague of multi national small pox at the other.

This is the elephant people are terrified will sit on them while they are on the sofa, sipping tea, hoping the elephant will wander out and get on with its business. But the elephant is hungry and unruly: it demands to be fed by public bail outs, but then laughs as it rewards the top of the structure with massive bonuses.

It won't be pulled on a chain: all you can do is either ignore it and wait until it inevitably needs fed next time, hoping the rather sick elephant gets better and on with its own business: or you can tie a rubber band to its trunk and start to pull. Often you will pull a bit, and then you will end up scurrying after it in the opposite direction. But eventually it will get nagged into following your gentle pulling and move a footstep towards you just to have a little tension off its' trunk.

Two areas which however bore her own brand of decision making and personal bloody mindedness, are the great white elephants of public spending: firstly the Trident Missile system.

By the late 70s Polaris was deemed obsolete: who decides that a system which could destroy the entire Moscow area several times over with very little at the time in the way of stopping the missiles once launched, is down to the USA and that most manipulatable asset, British pride. Even the "Chevaline" upgrade can be viewed as a sticking plaster on an ageing fleet of submarines which had become expensive to keep operational and were heavily manned.

The proposals were for a new multi-warhead intercontinental peri-stratospheric missile system which would have less crew and more computerisation. The alternative was for cruise missiles: medium range missiles launched from torpedo tubes, or longer range ones probably launched vertically like other submarine bourne ICBMs. The latter is now of course in debate again: on the plus side, it is a weapon system you can actually find use for in crisis, by loading with conventional warheads and firing without alerting the Russian-Chinese ICBM long range alert systems, and not causing a diplomatic incident after satellite intelligence reveals launches, given the trajectory is towards a target not sensitive to the super powers.

Trident was chosen in the 80s as the system of choice and work began in 1984 in earnest in fact. The construction phase of the "Boats" and the shore support cost a figure between four and six billion pounds. The missiles and much of the system testing of their launch and use was delivered by the US, with funding quoted as being "38%" but that is probably just the cost of the missiles, and given they produce them anyway, it is difficult to say what 'subsidy" the Uk ever actually had from "uncle Sam".

It is Ironic of course that British sovereignty was challenged by Argentina, with disregard to the potential use of Polaris. The Fascist Junta knew that the UK would never be allowed to even threaten them with it due to the Americans actually holding the finger that is under the finger on the UK "Button".

Secondly the ICBM became largely obsolete, at least for the UK's geo-strategic position with the rise of Glastnost-Peristroika-Democracia in the then USSR.

Trident then was rendered a white elephant by 1990, when a submarine cruise launched system could have been re-tasked to conventional warhead or even intelligence "drone" flights of cruise missiles into Iraq. Also of course the UK Royal Navy has acquired medium range, torpedo launch cruise missiles since then which would have a nuclear war head capacity if rebuilding of systems was instructed.

So there it is Trident: and possibly Trident II. The modernisation and effectivisation the NHS never got and never will have.

Her next great and of course white, elephant was Canary Wharf. Over a billion pounds in subsidies in an otherwise "free market, let them eat coal" reign. A pure ideological, interventional government hand out to cronies which took years to fill and was a financial disaster for the original developers.

The last elephant was born of this ideology in fact: a birth on the alter of the anarchical finance markets: The elephant in the living room, the elephant on the stock market floor, the elephant in the EU Commission and in little Davey Cameron's bedroom, under his bed at nights. That the freedom and deregulation has inevitably lead to a vulnerable, interconnected quasi system open to the vagiaries of even a single trader or type of transaction causing turmoil. Like the butterfly effect proposed on global weather, the anarchic deregulated markets can sneeze at one end and catch a plague of multi national small pox at the other.

This is the elephant people are terrified will sit on them while they are on the sofa, sipping tea, hoping the elephant will wander out and get on with its business. But the elephant is hungry and unruly: it demands to be fed by public bail outs, but then laughs as it rewards the top of the structure with massive bonuses.

It won't be pulled on a chain: all you can do is either ignore it and wait until it inevitably needs fed next time, hoping the rather sick elephant gets better and on with its own business: or you can tie a rubber band to its trunk and start to pull. Often you will pull a bit, and then you will end up scurrying after it in the opposite direction. But eventually it will get nagged into following your gentle pulling and move a footstep towards you just to have a little tension off its' trunk.

2013: The Financial Market Monster

As in 1979, now we stand again on a knife edge and the end of an old epoch, with the old epochers standing there like the Unions of the late 70s, and saying:

" we need more of the same!! Yes !! "

"More disease is the cure for the disease!!"

in other words, we need less regulation of financial markets and businesses, we need less democratic accountability and we need more divide between rich and poor by tax breaks to the wealthy and cuts in wages, welfare, schooling and state benefits to the masses.

Like 1979, we stand in need for leaders who will say no, more disease is not the cure, we need a new epoch with some bitter pills for some people to swallow in terms of credit and regulation.

" we need more of the same!! Yes !! "

"More disease is the cure for the disease!!"

in other words, we need less regulation of financial markets and businesses, we need less democratic accountability and we need more divide between rich and poor by tax breaks to the wealthy and cuts in wages, welfare, schooling and state benefits to the masses.

Like 1979, we stand in need for leaders who will say no, more disease is not the cure, we need a new epoch with some bitter pills for some people to swallow in terms of credit and regulation.

Thatcher: A legacy of Symbolism and Hypocrisy

As a prime minister, Margaret Thatcher had two full terms and was then ousted while in her third, not by the country who had by then voted over 50% of votes cast against her government, but by her own party. A betrayal but just like tackling the overly powerful unions of the late 70s, the overly powerful "female Fuhrer" had to be toppled because she had become an obstacle to policy making and progressive governance.

This is what really points to the symbolic Boadecia she was: a great figure head, great at showing the decisions the back room wanted to make, great at doing what her city advisors asked as long as she understood it in the context of a small british business. When the Frankenstein of education minister to party leader to PM began to show she was coming off her own rails, she was elbowed by the gray non event that was John Major, the only man who ever ran away FROM the circus to live a very dull life indeed.

Her legacy is like a glowing memory for many as we wade in the ashes of a Britain which is now based on funny "fictitious trading" money, power companies who cheat the public, and keynsian circles which help float the British Isles still owned by London.

Put another way, fewer people were on government benefits when in 1979 than when she left office in 1990. Britain entered full recession in the early 80s and it was more private companies who went bust than the public "failures" of mining, steel and car production. Companies which had never been propped up by the government and which had never had large scale industrial relations issues. It was biscuit bakeries, tyre plants and toy factories I remember on the ITN weekly toll and when ever we drove past Drumchapel in west Glasgow.

Just as now that an ambitious, high income, high spending Labour party get the blame for the ills of an equity trader's construct, the finance crisis, the biggest recession since the 30s, in fact a depression in most of southern europe, so did all this get blamed on the unions. Like the jews in 1920 and 30s Germany they became the scapegoat for the ills of a wider econo-cultural malaise.

Back to more on benefits once she left office: Big Bang and the relaxation of personal consumer credit, was of course going to both inject huge amounts of money into the south eastern economy of England and create a long term monster of paper-card-house building and legalised, neigh encouraged pyramid-selling. In the period 1980-1983 the UK did not fair well at all, when compared to socialist France and the centre right Germans. As I say, this wasn't because of the terrible public owned industries, it was that the old capitalist ways of unde-rinvesting, under-training, unmodernised and basically mediocre quality production had come to a crashing end as world demand for British products dived. Domestic demand also crashed. Without the Falklands War, Maggie may have lost to a lib-lab pact or at least been ousted. Public spending went UP as a proportion of GDP but the public sector borrowing requirement was addressed by selling off BA and shares in Rolls Royce amongst other tactics to pay off and restructure national debt.

So the Thatcher government set about firstly having to pay the dole bill for hundreds of thousands of workers from failing private industries which had collapsed under their own inertia. Also the government had to fund the Falklands war. First term Thatcher years: High public spending and Keynesian circles floating the country.

Second term: This is when the back room boys from the Adam Smith Inst, and the city got their way. Firstly, big bang would be allowed to go ahead and even accelerated. Also then consumer credit would be liberalised. More debt would be paid by further sales of public shares in "nationalised" companies and it was clear that GDP would swell from the City getting deregulated and of course yes, by the few strong industries enjoying less strikes, union disruptions and government intervention. Trident was also on the order books of Barrow in Furnace, Rolls Royce and Tarmac amongst many others as the biggest single spend in renewal of "assets" since WWII. Canary Wharf, at least a billion pounds of tax payers money, and more over, ideologically motivated public funds into an empty office block post black monday and the right sizing of the later eighties.

From a purely Nationalist right wing point of view, a UKIP stand point: what did Thatcher actually leave as her legacy? Well all that stock market freedom which helped investment in UK industry, also meant of course that UK brands- the embodiment of wealth creation, the big value-add to the bottom line, could be sold off to the Germans, the japanese and later of course, the Chinese - a crypto capitalist dicatatorship.

Also all that sabre rattling at Europe and the castration of Strasbourg as a potential democratic tool for harmony: She got her way, that strong national interests represented through Brussels and not Strasbourg, would get their way as we see today in 2013, five years into international crisis. So now that monster is eating away at the meaning of the EU: Germany is the strongest caller and the pied piper for now, with little Davey Cameron cocking his hat to that, while in fact a democratic body in Strasbourg with real powers and real accountability may have laid enough in the way of Eurozone to slow the introduction of the Euro, in so many lands, in terms of questions like those...well....those now actually answered - yes it can ruin your health. Strasbourg then could have tempered the ideology and put in place controls, rather than playing to the big drum beat of the dominant national governments.

Now we stand again on a knife edge and the end of an old epoch, with the old epochers standing there like the Unions of the late 70s, and saying " we need more of the same!! Yes !! More disease is the cure for the disease!!" in otherwords, we need less regulation of financial markets and businesses, we need less democratic accountability and we need more divide between rich and poor by tax breaks to the wealthy and cuts in wages, welfare, schooling and state benefits to the masses.

Like 1979, we stand in need for leaders who will say no, more disease is not the cure, we need a new epoch with some bitter pills for some people to swallow in terms of credit and regulation.

This is what really points to the symbolic Boadecia she was: a great figure head, great at showing the decisions the back room wanted to make, great at doing what her city advisors asked as long as she understood it in the context of a small british business. When the Frankenstein of education minister to party leader to PM began to show she was coming off her own rails, she was elbowed by the gray non event that was John Major, the only man who ever ran away FROM the circus to live a very dull life indeed.

Her legacy is like a glowing memory for many as we wade in the ashes of a Britain which is now based on funny "fictitious trading" money, power companies who cheat the public, and keynsian circles which help float the British Isles still owned by London.

Put another way, fewer people were on government benefits when in 1979 than when she left office in 1990. Britain entered full recession in the early 80s and it was more private companies who went bust than the public "failures" of mining, steel and car production. Companies which had never been propped up by the government and which had never had large scale industrial relations issues. It was biscuit bakeries, tyre plants and toy factories I remember on the ITN weekly toll and when ever we drove past Drumchapel in west Glasgow.

Just as now that an ambitious, high income, high spending Labour party get the blame for the ills of an equity trader's construct, the finance crisis, the biggest recession since the 30s, in fact a depression in most of southern europe, so did all this get blamed on the unions. Like the jews in 1920 and 30s Germany they became the scapegoat for the ills of a wider econo-cultural malaise.

Back to more on benefits once she left office: Big Bang and the relaxation of personal consumer credit, was of course going to both inject huge amounts of money into the south eastern economy of England and create a long term monster of paper-card-house building and legalised, neigh encouraged pyramid-selling. In the period 1980-1983 the UK did not fair well at all, when compared to socialist France and the centre right Germans. As I say, this wasn't because of the terrible public owned industries, it was that the old capitalist ways of unde-rinvesting, under-training, unmodernised and basically mediocre quality production had come to a crashing end as world demand for British products dived. Domestic demand also crashed. Without the Falklands War, Maggie may have lost to a lib-lab pact or at least been ousted. Public spending went UP as a proportion of GDP but the public sector borrowing requirement was addressed by selling off BA and shares in Rolls Royce amongst other tactics to pay off and restructure national debt.

So the Thatcher government set about firstly having to pay the dole bill for hundreds of thousands of workers from failing private industries which had collapsed under their own inertia. Also the government had to fund the Falklands war. First term Thatcher years: High public spending and Keynesian circles floating the country.

Second term: This is when the back room boys from the Adam Smith Inst, and the city got their way. Firstly, big bang would be allowed to go ahead and even accelerated. Also then consumer credit would be liberalised. More debt would be paid by further sales of public shares in "nationalised" companies and it was clear that GDP would swell from the City getting deregulated and of course yes, by the few strong industries enjoying less strikes, union disruptions and government intervention. Trident was also on the order books of Barrow in Furnace, Rolls Royce and Tarmac amongst many others as the biggest single spend in renewal of "assets" since WWII. Canary Wharf, at least a billion pounds of tax payers money, and more over, ideologically motivated public funds into an empty office block post black monday and the right sizing of the later eighties.

From a purely Nationalist right wing point of view, a UKIP stand point: what did Thatcher actually leave as her legacy? Well all that stock market freedom which helped investment in UK industry, also meant of course that UK brands- the embodiment of wealth creation, the big value-add to the bottom line, could be sold off to the Germans, the japanese and later of course, the Chinese - a crypto capitalist dicatatorship.

Also all that sabre rattling at Europe and the castration of Strasbourg as a potential democratic tool for harmony: She got her way, that strong national interests represented through Brussels and not Strasbourg, would get their way as we see today in 2013, five years into international crisis. So now that monster is eating away at the meaning of the EU: Germany is the strongest caller and the pied piper for now, with little Davey Cameron cocking his hat to that, while in fact a democratic body in Strasbourg with real powers and real accountability may have laid enough in the way of Eurozone to slow the introduction of the Euro, in so many lands, in terms of questions like those...well....those now actually answered - yes it can ruin your health. Strasbourg then could have tempered the ideology and put in place controls, rather than playing to the big drum beat of the dominant national governments.

Now we stand again on a knife edge and the end of an old epoch, with the old epochers standing there like the Unions of the late 70s, and saying " we need more of the same!! Yes !! More disease is the cure for the disease!!" in otherwords, we need less regulation of financial markets and businesses, we need less democratic accountability and we need more divide between rich and poor by tax breaks to the wealthy and cuts in wages, welfare, schooling and state benefits to the masses.

Like 1979, we stand in need for leaders who will say no, more disease is not the cure, we need a new epoch with some bitter pills for some people to swallow in terms of credit and regulation.

Critics of Thatcher Cast into Being Marxist Leninists! Nonsense!

To further perpetuate the 'cult of the Female Fuhrer', it seems any criticism of Maggie marks the opponent out as a supporter of the marxist unions of the later 70s in the Uk.

You could equally say that opponents of the Male Fuhrer, Hitler, were then all Bolshevik revolutionaries hell bent on the destruction of democracy.

The fact is that of course the Unions of the late 70s would have destroyed the British economy in the recession of 1980 to 1985, and brought the UK to the IMF in the same way as Greece, Spain, Portugal and more recently, Cyprus have had to doth cap and beg to the 'Fuhrer-land'.

In the end of course, Thatcher became a burden on the Tory party itself, with the cult of the leader going to far such that once the beast they had created and nurtured began to not make the right noises in 1989, and started talking in the Royal "We", then her critics became her cabinet and groups of back benchers. They ushered in the "non governance" of the 1990s with privatisation of the railways and power industries as their supposed successes that lead to super inflationary pet gargoyles which are grossly unpopular with most customers on or below average incomes.

You could equally say that opponents of the Male Fuhrer, Hitler, were then all Bolshevik revolutionaries hell bent on the destruction of democracy.

The fact is that of course the Unions of the late 70s would have destroyed the British economy in the recession of 1980 to 1985, and brought the UK to the IMF in the same way as Greece, Spain, Portugal and more recently, Cyprus have had to doth cap and beg to the 'Fuhrer-land'.

In the end of course, Thatcher became a burden on the Tory party itself, with the cult of the leader going to far such that once the beast they had created and nurtured began to not make the right noises in 1989, and started talking in the Royal "We", then her critics became her cabinet and groups of back benchers. They ushered in the "non governance" of the 1990s with privatisation of the railways and power industries as their supposed successes that lead to super inflationary pet gargoyles which are grossly unpopular with most customers on or below average incomes.

Wednesday 10 April 2013

The New Epoch, like the late Seventies to Late Eighties Paradigm Movement

I believe now that we stand at a point which can be very much compared to that of the mid to late 70s.

A previous epoch has run its course. In the 70s, unions and governance became too strong and old capital became too lazy to modernise economies. More than just the seeds were there for the new Epoch: it was not like Thatcher and Reagan waived a wand: their economic policies were a result of the best post-post war economists thinking up solutions in the 1970s which found voice in a former actor and a former house wife oddly enough.

As in the 70s when the unions became too powerful and hindered economic growth, and the rich too complacent and detached from managing production and value creation, we now have a stage where the bankers have become too powerful and there is still too much money locked up in property.

There has to be some tough, uncompromising decisions and one thing is certain: we do not need more anarchy! We do not need to liberalise a broken liberal banking system anymore. Like the Unions they have become arrogant and detached from the public and act in self interest. Like the unionised industries they can hold a gun to the head of government and demand money while insisting their way is essential and their members should be untouchable.

There are other areas of the markets which need to be liberalised before anyone injects more governless road maps to the banking sector; American and European agriculture for a start. Also the housing market and "real estate" : governments need to both free up ground for building but also coax the market into building affordable homes instead of the now obsolete yuppie rabbit cages which promised maximum ROI before for all concerned.

A top Norwegian economist shares some of these views, but goes further: he means like many market fundamentalists and Marxist-socialists, that the banks should have been allowed to fail. Yes it would have devastated value and savings and pensions, but it would reduce the sector to having investors who are cautious of where they place their money, and conscious that money which is nearer value creation pays better than money which is based on a house-of-cards.

Which ever way it went, we would have seen socialism: bail outs for banks and key industries, taxation for the rich (investors in Cyprus the current flavour-of-month) some more poverty for a while and then a resurgence after fundamental value creation and human interaction gets money flowing out of pockets, personal equity and the safe havens where so much money is now lingering.

We have by in large conquered high , uncontrollable inflation! Just think, we may say in our lives now for the next 20 years, that market mechanisms and judicious governance will result in less than 5% inflation. After that there will be a huge energy crisis and possibly a "perfect storm" of an unpredictable fluctuating climate coupled to the oil and coal crisis. Governments need to act to day in fundamental R&D and legislation to enable this to be a transition in 20 years time, and not a market mechanism "correction" because the market by in large so short sighted that there will be catastrophe before it adjusts the world.

That is the key point; that governments have the role to plan and tackle longer term, spread cost issues: like roads, other infrastructure, education and basic R&D. To legislate for movements to more desirable market conditions. To also create those conditions were market supply can operate to solve future problems, the two biggest being climate change and the energy crisis with other resource crises plural being a natural fall out of poor planning and a market which cannot then respond to the conditions quickly enough.

A previous epoch has run its course. In the 70s, unions and governance became too strong and old capital became too lazy to modernise economies. More than just the seeds were there for the new Epoch: it was not like Thatcher and Reagan waived a wand: their economic policies were a result of the best post-post war economists thinking up solutions in the 1970s which found voice in a former actor and a former house wife oddly enough.

As in the 70s when the unions became too powerful and hindered economic growth, and the rich too complacent and detached from managing production and value creation, we now have a stage where the bankers have become too powerful and there is still too much money locked up in property.

There has to be some tough, uncompromising decisions and one thing is certain: we do not need more anarchy! We do not need to liberalise a broken liberal banking system anymore. Like the Unions they have become arrogant and detached from the public and act in self interest. Like the unionised industries they can hold a gun to the head of government and demand money while insisting their way is essential and their members should be untouchable.

There are other areas of the markets which need to be liberalised before anyone injects more governless road maps to the banking sector; American and European agriculture for a start. Also the housing market and "real estate" : governments need to both free up ground for building but also coax the market into building affordable homes instead of the now obsolete yuppie rabbit cages which promised maximum ROI before for all concerned.

A top Norwegian economist shares some of these views, but goes further: he means like many market fundamentalists and Marxist-socialists, that the banks should have been allowed to fail. Yes it would have devastated value and savings and pensions, but it would reduce the sector to having investors who are cautious of where they place their money, and conscious that money which is nearer value creation pays better than money which is based on a house-of-cards.

Which ever way it went, we would have seen socialism: bail outs for banks and key industries, taxation for the rich (investors in Cyprus the current flavour-of-month) some more poverty for a while and then a resurgence after fundamental value creation and human interaction gets money flowing out of pockets, personal equity and the safe havens where so much money is now lingering.

We have by in large conquered high , uncontrollable inflation! Just think, we may say in our lives now for the next 20 years, that market mechanisms and judicious governance will result in less than 5% inflation. After that there will be a huge energy crisis and possibly a "perfect storm" of an unpredictable fluctuating climate coupled to the oil and coal crisis. Governments need to act to day in fundamental R&D and legislation to enable this to be a transition in 20 years time, and not a market mechanism "correction" because the market by in large so short sighted that there will be catastrophe before it adjusts the world.

That is the key point; that governments have the role to plan and tackle longer term, spread cost issues: like roads, other infrastructure, education and basic R&D. To legislate for movements to more desirable market conditions. To also create those conditions were market supply can operate to solve future problems, the two biggest being climate change and the energy crisis with other resource crises plural being a natural fall out of poor planning and a market which cannot then respond to the conditions quickly enough.

Thatcher: The Female Führer

Looking back at the rhetoric and actions of Mrs T, one side of me and many respects the tackling of man ills in Britain and the rise of meritocracy she was both a symbol and protagonist for. The other side of me now remembers the bitterness she spoke of many landsmen and the lack of compassion for those once called " the enemy within"

"We had to fight the enemy without in the Falklands. We always have to be aware of the enemy within, which is much more difficult to fight and more dangerous to liberty"

which coupled to her middle-class-bourgeois "kulturkampf" can be easily likened to :

"Those nations who are still opposed to us will some day recognize the greater enemy within"

: from another democratically elected leader, who also chose to demonise an otherwise productive sector of society, Adolf Hitler.

So in remembering her rhetoric and lack of respect for communities which had once paved London streets with golden stock traders salaries,

I think of her also then as the Female Führer, with the miners and steel workers as her enemy within, her Jews and gypsies.

A culture of a life and family commitment to the two industries which subsidies or not, had built Britains wealth: the raw supply for value conversion which finds reward on the stock market. Only the investment-. ROI was biased. The industries weren't modernised. The ironies are abundant: we imported subsidised coal from New Zealand and from the then communist Poland during the miners strike. After the planned downsizing, the command economy of reducing world capacity for steel closed one of the most productive mills in the world, Ravenscraig, it took only a few years for there to be a shortage of steel and a protected market in the US conserving its own capacity. That the union jack waving privatisations of Rover, and the stock market freedoms lead to the Germans and Chinese raking out our brands and technologies.

In the same way as Jewish citizens in 1920s Germany were often the most productive and enterprising peoples, who made many Christian Germans wary and lead to them being an easy target, so the steel and coal workers were a productive backbone from the indsutrial revolution, through the war years and into the last great epoch of Britain as an manufacturing giant from the 50s to the early 70s. She demonised this class of workers who were dependent on their pits and mills, letting her own "

"We had to fight the enemy without in the Falklands. We always have to be aware of the enemy within, which is much more difficult to fight and more dangerous to liberty"

which coupled to her middle-class-bourgeois "kulturkampf" can be easily likened to :

"Those nations who are still opposed to us will some day recognize the greater enemy within"

: from another democratically elected leader, who also chose to demonise an otherwise productive sector of society, Adolf Hitler.

So in remembering her rhetoric and lack of respect for communities which had once paved London streets with golden stock traders salaries,

I think of her also then as the Female Führer, with the miners and steel workers as her enemy within, her Jews and gypsies.

A culture of a life and family commitment to the two industries which subsidies or not, had built Britains wealth: the raw supply for value conversion which finds reward on the stock market. Only the investment-. ROI was biased. The industries weren't modernised. The ironies are abundant: we imported subsidised coal from New Zealand and from the then communist Poland during the miners strike. After the planned downsizing, the command economy of reducing world capacity for steel closed one of the most productive mills in the world, Ravenscraig, it took only a few years for there to be a shortage of steel and a protected market in the US conserving its own capacity. That the union jack waving privatisations of Rover, and the stock market freedoms lead to the Germans and Chinese raking out our brands and technologies.

In the same way as Jewish citizens in 1920s Germany were often the most productive and enterprising peoples, who made many Christian Germans wary and lead to them being an easy target, so the steel and coal workers were a productive backbone from the indsutrial revolution, through the war years and into the last great epoch of Britain as an manufacturing giant from the 50s to the early 70s. She demonised this class of workers who were dependent on their pits and mills, letting her own "

Tuesday 9 April 2013

What did Maggie Thatcher think of The Bank Bail Outs post 2008?

The banks suceeded where 20 years of conservative policy had prevented it: a failed industry, crippled by weak management and chaotic structuring of products was bailed out lock stocks and barrells of bonuses.

Thatcher tried to reverse propping up industries, which somehow ended up in a bizarre situation the UK finds itself in now: both the lowest unemployment rates yet the highest poverty rates of the big 3 economies.

20 Billion was the bail out to HBOS. Failure would have been unthinkable: just as the failure of the privately owned, listed company British Leyland was unthinkable in the mid 70s when in fact the private management of BMC had still wanted to market 1950s models into the 1970s. 180,000 direct employees. Toyota; VW and even BMW made mostly small, rather odd cars. BL made some turkeys but made some great cars: the maxi, the mini, the marina, the TR6, the sptifire, the MGB/C, landrover, the big SD1 so iconic of late 70s traffic police and senior managers.

Why is the "bail out" of banks not seen as the same old socialism as the "nationalisation" of BL which is what it was in fact, not really full nationalisation like the airports, and only using limited involvement in the running of BL . It was a share purchase bail out for a failing private company which made some damn good products.

Britain has such high employment and high poverty because it is in effect still a subsidy junky. Instead of letting the banks fail they bailed them out, so the casino royale can play again knowing that mummy state will wipe their bums again.

Also take housing benefit: a massive subsidy to private property developers and rachmans. Then of course working family benefits: an excuse to allow service industry to pay as little as possible to employees and let the state bail them out with indirect subsidy as opposed to trade unions offering a natural, devolved means of fighting for the balance to feed families.

Are you that proud to be British when the Germans, Indians and Chinese own our old brand and command many of the new brands ?

Is this the natural end of the bullshit show of personal credit and house price equity release which the UK has been living off for 20 years ?

Thatcher tried to reverse propping up industries, which somehow ended up in a bizarre situation the UK finds itself in now: both the lowest unemployment rates yet the highest poverty rates of the big 3 economies.

20 Billion was the bail out to HBOS. Failure would have been unthinkable: just as the failure of the privately owned, listed company British Leyland was unthinkable in the mid 70s when in fact the private management of BMC had still wanted to market 1950s models into the 1970s. 180,000 direct employees. Toyota; VW and even BMW made mostly small, rather odd cars. BL made some turkeys but made some great cars: the maxi, the mini, the marina, the TR6, the sptifire, the MGB/C, landrover, the big SD1 so iconic of late 70s traffic police and senior managers.

Why is the "bail out" of banks not seen as the same old socialism as the "nationalisation" of BL which is what it was in fact, not really full nationalisation like the airports, and only using limited involvement in the running of BL . It was a share purchase bail out for a failing private company which made some damn good products.

Britain has such high employment and high poverty because it is in effect still a subsidy junky. Instead of letting the banks fail they bailed them out, so the casino royale can play again knowing that mummy state will wipe their bums again.

Also take housing benefit: a massive subsidy to private property developers and rachmans. Then of course working family benefits: an excuse to allow service industry to pay as little as possible to employees and let the state bail them out with indirect subsidy as opposed to trade unions offering a natural, devolved means of fighting for the balance to feed families.

Are you that proud to be British when the Germans, Indians and Chinese own our old brand and command many of the new brands ?

Is this the natural end of the bullshit show of personal credit and house price equity release which the UK has been living off for 20 years ?

Monday 8 April 2013

Thatcher: The Messiah of the Bourgeois

Maggie, the Iron Ladette, is gone.

She was most of all a Messiah for the Bourgeios. A kind of figure head against the old stodgy conservatism and inverted snobbery and a champion against the overly powerful unions.

The public had no stomach for the excesses of the unions, whose members paid a huge price

for their own arrogance. Unions now do not command the respect they deserve and de-unionisation is still seen as a goal for companies in the UK.