Friday, 19 April 2013

De-growth and Natural Western Economic Downsizing

Growth in GDP has been the central mantra of all orthodox and respected economists in modern times, and quite possibly been the theme which was born when the term economy was first used.

Now we are currently and quite probably in a phase in western economies where there is contraction in the general economy, and GDP will fall in many western countries, or be subject to vagiaries of key commodities or economic activities such as the financial markets in actually determining any net growth on top of a more general down-sizing happening on several levels.

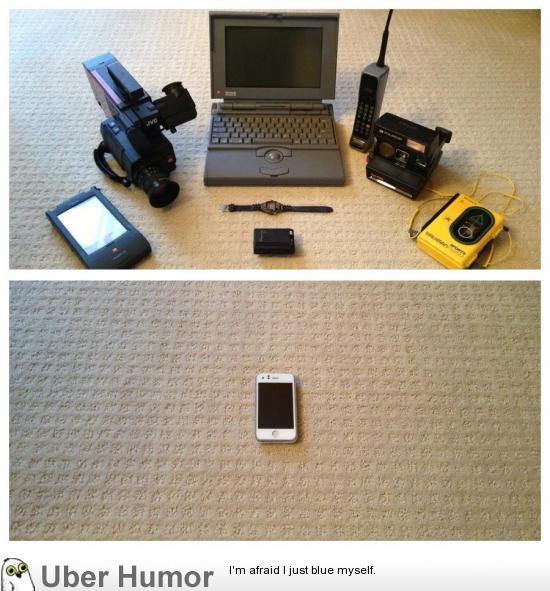

Firstly on the personal level, we see the example above of how modern products are down sizing demand. HTC in particular are victims of their own succsess- I own a 2 year old Desire and it is in very good working order, able to run all but the heaviest new software app's on the market and a sturdy multitasking phone with a great camera. Apple build in "style obsolescence which is a massive intellectual and logtistics activity to get their brand bought when in fact the old product matches the physical needs.

I believe the economic recession is more than just a normal stage in the previous post war cyclical pattern I grew up with. Rather, the cause is the symptom and the reason change is so slow now: the west became increasingly locked into a financial system which was anarchic and the previous mechanisms for extracting value from the movements of money, commodities and capital evolved into a free-for-all where cheating became the norm, dressed up in ever more fancy language.

Basically western economies were not adding enough value to goods and services, while investment in the far east and emergent nations as the providers of basic value-multiplication centres, was restricted by Chinese, Indian, Korean and Brazilian governance.

Some pundits talk of the sub prime social policy as being the root cause of this collapse, and point to governmental intervention and the butterfly-effect meaning that any distortion to a market can have these seismic ripples. However they are most often the same bankers and economists who support bail outs for failed, high risk and law breaking banks and austerity measures which will restrict growth further and place more western workers out of work, while also cutting demand for western products in the emergent economies in a viscous circle. Oil and gold this week are both down.

Rather I say that the over valuing of markets and the over stating of returns on complicated and often illegal financial products or vehicles, was inevitable and the sub prime was just the final catalyst for it all to happen.

De-growth is then actually not a consequence of the finance crisis, it is one of the causes and itself now is being exacerbated by austerity measures. It is a natural phenomenon that the west will drift into Keynesian cyclical service industry and higher intellectual value, lower employee per dollar margin activities such as finance and design within high technology areas. Also that the gross margin enjoyed form the early nineties to early nought'ies by western companies with their brand management and design, is now running over to Korea, Japan and China with the next layer building up in other BRICKS countries whose business graduates know the game: brand is king of margin.

On some of the governmental sides, the USA in particular and Europe will see a steady decline in defence spending, with the Right's own economic rottweilers questioning every dollar or Euro spent on this. It doesn't look great for many in defence: right sizing of armies as the west re-thinks invasive policies in Islamic countries, down sizing our navy due to advances in technology and the re-tasking they have in front of them, and then there is the biggest single project down size and potential catastrophe, the international F35 joint fighter which is down sized in orders, late and may not be the one size fits all it was billed to be.

Japan is the first major economy to turn its back on austerity: this is because it has had two decades nearly of slow growth. Germany will never need to follow suit? Well the austerity lead by the Germans will lead to far lower demand for the premium products and high quality technical expertise they have spent so long building as a brand and quality leader in the EU and internationally. The fact is that France, the UK and the low countries have not actually yet seen the real job losses which are a direct result of austerity that is being legislated now.

Many hark back to the cure of the mid to late 30s and a return to higher borrowing, higher cash flow and higher inflation as the only kick start to the west. Others say that recovery will be a natural result of good fiscal policy, but that is actually relatively speaking a hope-and-a-prayer versus established economic history. We are not in 1978 when an IT and liberalistaion revolution could be forseen and pushed through, we are in a time when the west is still loosing value creation to the far east without very much to liberalise without there being more basis for the same corruption and anarchy which lead us to this crisis.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment